The COVID-19 pandemic is having and will continue to have a significant impact on global M&A transactions. Several businesses have shuttered or cut back their operations significantly, millions of workers have been laid off or furloughed, consumer spending has been drastically reduced, supply chains have been disrupted, and demand for oil and other energy sources has plummeted.

The impact of the pandemic:

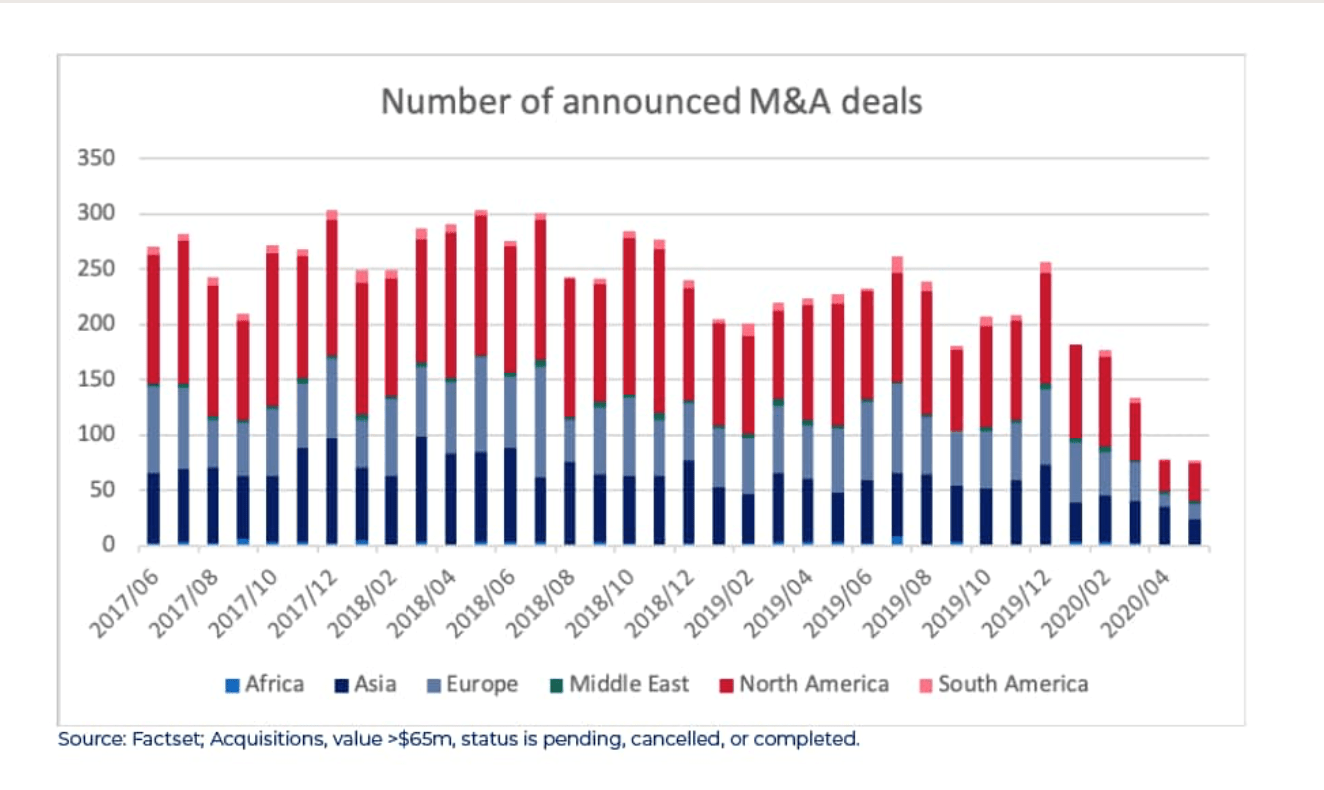

The pandemic has affected the M&A activity globally, across corporate and private-equity buyers and across domestic and international deals.

LexisNexis said: “This is the lowest half-yearly aggregate deal value for UK public M&A transactions since H1 2009 when there were five firm offers with an aggregate deal value of £1.3bn, and compares with aggregate deal values of £26.5bn and £27.5bn and average deal values of £802m and £833m in H1 2019 and H2 2019 respectively.”

Many governments are introducing or increasing the scope of existing, foreign direct investment regimes, fearing threats to national security, loss of control over critical infrastructure, the potential for opportunistic acquisitions, especially by buyers affiliated with a foreign government.

The CMA has published guidance on the application of UK merger control rules during the crisis. The guidance confirms that the timescales under which the CMA is required to operate have not been altered. However, it notes that the pre-notification process in some cases will take longer than usual because of difficulties in obtaining information from the merging parties and third parties.

Looking ahead:

Due Diligence

Working remotely has become the new norm, and it is likely that it will be here to stay in some form. Working from home needs tools to keep transaction data secure, and to make transactions simpler.

Data rooms will become a vital part of each deal, and their functionality may evolve to facilitate other areas of the transaction. Partnering with a trusted, established player in the data room field will be more essential than ever.

Due diligence will focus more closely on strategies being deployed by the target to cope with Covid-19. New amendments, emergency planning procedures, insurance quotes and cancellation options could suddenly become commonplace in the most straightforward of agreements. Law firms and M&A business will likely be doing everything they can to cover themselves for either the next Covid-19 wave, or a future crisis which could plunge the sector, and wider economy, into chaos.

Organising the documents for due diligence will become more challenging. However, the safest, easiest and most effective way to share documents during a transaction is with the use of a virtual data room (VDR). A data room is extremely quick to set up, eliminates the need for face-face contact during due diligence and includes flexible, secure and easy to navigate controls.

Representations/Warranties

If representations and warranties have already been given, the seller needs to check that it has not inadvertently breached any of them or that they can still be repeated at closing, if applicable, without any additional disclosures being made. If the agreement is still being negotiated, a buyer needs to consider whether it should include some COVID-19 specific warranties as a way of eliciting more information about any risks and potential impacts of the virus on the target business.

Deal timetable

The pandemic is also impacting deal timetables, as the ability for some authorities to conduct merger reviews has become more constrained. With social distancing restrictions, reaching a deal will undoubtedly require more time especially in more complex cases. It is expected to see greater reliance on the use of electronic signature platforms and, with the end of face-to-face meetings. Virtual meetings are here to stay and can replace most face-to-face meetings involved in M&A deals, including due diligence, signing and closing meetings.

Generally, going forward we expect that parties will continue to use virtual platforms for most deal processes and for the technology to continue to evolve to make this more effective. As a result, the deal cycle could get shorter as it is easier to schedule a virtual meeting than to coordinate multiple travel plans.

While an ideal strategy for a bidder might be to use an extended possible offer period as a way of obtaining clearances without being committed to proceed with a firm offer, this is unlikely to be palatable to a target as it will want to ensure that the bidder is locked in. Where there is regulatory uncertainty around a transaction, target companies will also be very much focussed on deal protection

The ability to move quickly will also have the benefit of minimising the period until the target is under bidder control, something that is likely to be particularly relevant in certain sectors.

Tech market

2020 is likely to see a fairly lower number of M&A deals compared to 2019. The future market is believed to be a convergence of emerging technologies including IoT, 5G, data analytics, and edge computing. The tech M&A market is expected to remain among the key areas of investment for corporate as well as financial buyers. Given that tech companies are all geared up to bring 5G, virtual reality, 3D printing among others into the mainstream.

When it comes to the future of M&A market, it is assumed that the same will be driven by strategic buyers and venture capitalists. Due to reasons such as higher risk profile and initial stages of tech adoption, the investments in the future could be categorised by relatively low deal value.

About Ruby Datum:

Ruby Datum is a pioneering VDR platform with a strong emphasis on user experience. Breaking the mould of the usual cumbersome API’s and documentation often found around VDRs, Ruby Datum takes a fresh approach by assigning dedicated developers to clients. With plenty of automation and unrivalled speed, Ruby Datum is quickly gaining the recognition it deserves amongst Law Firms both small and large.

Designed to run fast and intuitively on any device (even when the connection is poor), Ruby Datum offers a truly accessible solution. Find documents with ease, thanks to our highly accurate character recognition and search engine algorithm. We most likely have the features you require, so please get in touch with any enquiries.

Our team has more than 10 years of experience with VDR and is on hand around the clock to provide full technical support. Our pricing is both simple and transparent, ensuring No hidden costs. Our infrastructure is of the highest grade and we cut no corners to ensure your virtual data room is secure, fast and available when you need it.

Categorised in: Legal Tech, Staff Blog