Covid-19 impacted negatively the whole deal market in the first half of 2020. However, we can be optimistic about the second half of 2020 with companies feeling better about their revenue outlook and investors seeing the technology sector as a safe haven. In this blog post we will delve into the basics of M&A and explore the types of M&A transactions as well as the main drivers behind every deal.

What is M&A and what is the difference between Mergers and Acquisitions

So what is Mergers and Acquisitions or short M&A? Simply said, it is the buying or selling of companies. But what exactly is the difference between Mergers and Acquisitions? When one company takes over another company and establishes itself as the new owner, the deal falls under the term Acquisitions. On the other hand, two companies merge when they agree to form a new entity together which operates as a new company. We can differentiate between hostile and friendly takeover. A hostile takeover is when the board of directors of the target do not approve the offer. The acquiring company can achieve hostile takeover when it goes directly to the target’s shareholders. In friendly takeovers the transaction is a result of the consent of both companies’ boards of directors. Furthermore, there are two forms of transaction – share and asset purchase. Share purchase is the process of buying the legal entity of the target company, whereas assets purchase is characterized by buying all or some of the target’s assets. The payment methods for each M&A deal can be cash, shares or the combination of both.

The main types of M&A

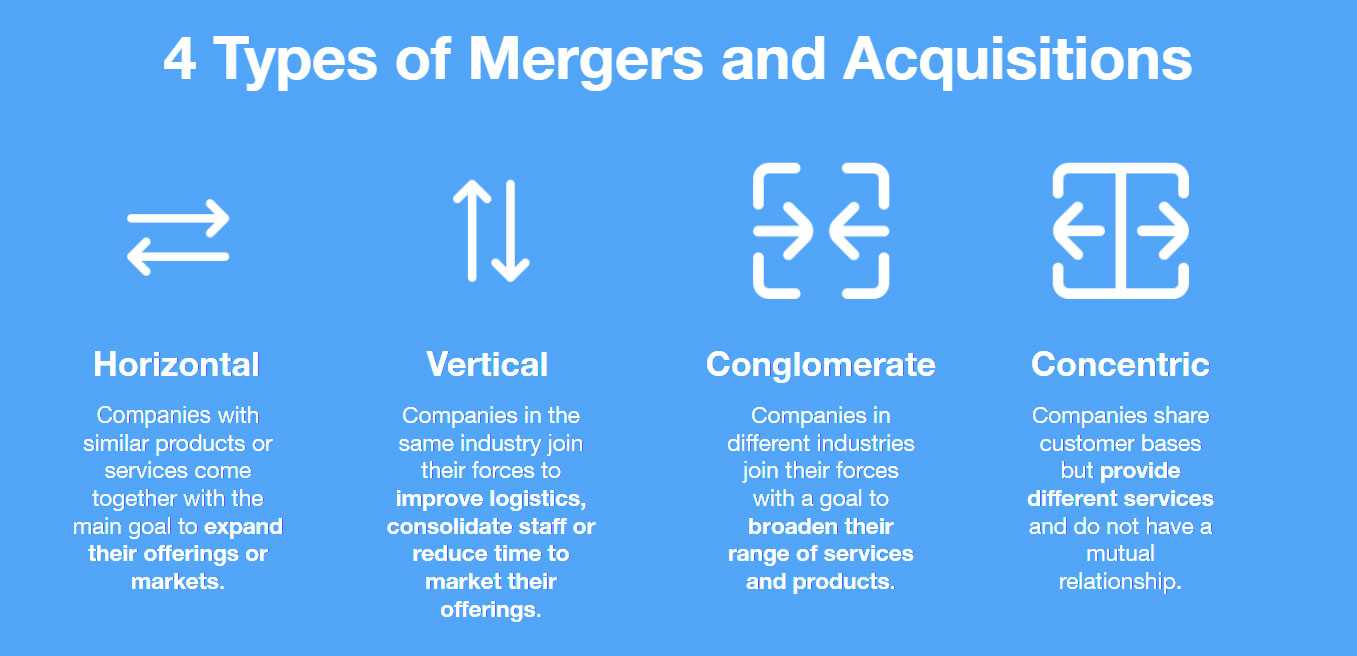

There are four main types of M&A transactions.

1. Horizontal merger

When two companies in the same industry or with the same product/service come together, there is a horizontal merger. The goal behind this kind of transaction is to expand the market share, achieve economies of scale and revenue, cost or financial synergies.

2. Vertical merger

The vertical integration happens when two companies within the same industry but in a different position in the supply chain (for example, a company and its supplier or its customer). The rationale behind the vertical integration is higher quality control and optimized logistics as well as consolidation of staff and synergies.

3. Conglomerate merger

Typical for conglomerate merger is the fact that companies which merge operate in different markets, industries and have different business lines. The value from these deals is in expansion in new products or services and ideally in cost savings.

4. Concentric merger

A concentric merger occurs when two companies that sell different products but have the same customer come together. The strategy behind it is to group products and gain access to bigger customer base.

As we see there are various reasons behind M&A deals. Companies pursue M&A transactions as a source of achieving economies of scale, elimination of competition, reduction of operating costs and adoption of modern technologies which contributes with the highest percentage to the deal volume in the past years. Companies develop myriad strategies for creating value with mergers and acquisitions but only a few are likely to do so, especially in the uncertain times post-Covid 19.

Stay tuned to learn more about M&A trends in our following blog posts.

Categorised in: Legal Tech